In the bustling city of Reno, young professionals and adults often juggle numerous priorities, from career growth to personal development. However, one aspect that frequently gets overlooked is health insurance. Many young and healthy individuals question the necessity of health insurance, especially when medical issues seem like a distant concern. But the reality is, health can be unpredictable, and the cost of medical care is consistently rising. Investing in health insurance early not only serves as a financial safety net but also offers comprehensive coverage with lower premiums.

Securing Lower Premiums and Better Terms

Starting your health insurance journey early in life, particularly in your 20s and 30s, can be significantly cost-effective. Insurance companies often offer lower premiums to younger, healthier individuals as they are viewed as lower risk compared to older clients. By locking in these advantageous rates, you not only save money in the short term but also secure favorable terms that can benefit you in the long run.

Investing in health insurance at a younger age is not just about immediate benefits. It's an integral part of sound financial planning. By securing lower rates now, you're setting up a foundation for financial stability. Health insurance can protect you from unexpected medical expenses that can derail your financial goals, ensuring that your savings and investment plans remain on track.

Protection Against the Unforeseen

No one can predict when a medical emergency will strike. Even if you're the epitome of health right now, accidents and sudden illnesses are realities of life. Having health insurance in place means you're prepared for these unforeseen events. It's not just about having a backup plan; it's about ensuring that you can receive the best possible care without the stress of overwhelming expenses.

Knowing that you're covered in case of emergencies brings peace of mind not just to you, but also to your loved ones. Your family and friends can rest easy knowing that your health and finances are protected, allowing them to focus on supporting you through recovery rather than worrying about medical bills.

Regular Check-ups and Early Detection

One of the often-overlooked benefits of health insurance is access to preventive care. Regular check-ups, screenings, and vaccinations are crucial for maintaining good health and early detection of potential health issues. With health insurance, these preventive measures are often covered, encouraging you to take proactive steps in managing your health.

By taking advantage of preventive care, you're not just taking care of your current health; you're investing in your future well-being. Regular health monitoring can lead to early intervention, lessening the severity of potential health issues and reducing long-term healthcare costs.

Building a Comprehensive Financial Safety Net

Health insurance is more than just a medical necessity; it's a crucial component of a comprehensive financial strategy. It protects you from the risk of incurring debt due to unexpected medical expenses, ensuring that your financial goals and lifestyle are not compromised.

Including health insurance in your financial planning provides a sense of security, knowing that you're prepared for life's uncertainties. It's an investment in your peace of mind, safeguarding your health and financial future.

As a young adult or professional in Reno, taking control of your health and financial future is crucial. Nevada Silver offers a range of health insurance plans tailored to meet your needs and lifestyle. We encourage you to explore these options, get a quote, or contact an agent for personalized consultation. Investing in health insurance is not just a prudent decision for today; it's a step towards securing your future.

In conclusion, health insurance is a smart investment for young and healthy individuals in Reno, offering cost-effectiveness, long-term benefits, and peace of mind. Don't wait until a medical emergency strikes; take control of your health and financial future today with Nevada Silver.

Explore why investing in health insurance is a wise decision for young and healthy individuals in Reno. Learn about the benefits, cost-effectiveness, and long-term value of having coverage with Nevada Silver.

In the bustling city of Reno, young professionals and adults often juggle numerous priorities, from career growth to personal development. However, one aspect that frequently gets overlooked is health insurance. Many young and healthy individuals question the necessity of health insurance, especially when medical issues seem like a distant concern. But the reality is, health can be unpredictable, and the cost of medical care is consistently rising. Investing in health insurance early not only serves as a financial safety net but also offers comprehensive coverage with lower premiums.

Starting your health insurance journey early in life, particularly in your 20s and 30s, can be significantly cost-effective. Insurance companies often offer lower premiums to younger, healthier individuals as they are viewed as lower risk compared to older clients. By locking in these advantageous rates, you not only save money in the short term but also secure favorable terms that can benefit you in the long run.

Investing in health insurance at a younger age is not just about immediate benefits. It's an integral part of sound financial planning. By securing lower rates now, you're setting up a foundation for financial stability. Health insurance can protect you from unexpected medical expenses that can derail your financial goals, ensuring that your savings and investment plans remain on track.

No one can predict when a medical emergency will strike. Even if you're the epitome of health right now, accidents and sudden illnesses are realities of life. Having health insurance in place means you're prepared for these unforeseen events. It's not just about having a backup plan; it's about ensuring that you can receive the best possible care without the stress of overwhelming expenses.

Knowing that you're covered in case of emergencies brings peace of mind not just to you, but also to your loved ones. Your family and friends can rest easy knowing that your health and finances are protected, allowing them to focus on supporting you through recovery rather than worrying about medical bills.

One of the often-overlooked benefits of health insurance is access to preventive care. Regular check-ups, screenings, and vaccinations are crucial for maintaining good health and early detection of potential health issues. With health insurance, these preventive measures are often covered, encouraging you to take proactive steps in managing your health.

By taking advantage of preventive care, you're not just taking care of your current health; you're investing in your future well-being. Regular health monitoring can lead to early intervention, lessening the severity of potential health issues and reducing long-term healthcare costs.

Health insurance is more than just a medical necessity; it's a crucial component of a comprehensive financial strategy. It protects you from the risk of incurring debt due to unexpected medical expenses, ensuring that your financial goals and lifestyle are not compromised.

Including health insurance in your financial planning provides a sense of security, knowing that you're prepared for life's uncertainties. It's an investment in your peace of mind, safeguarding your health and financial future.

As a young adult or professional in Reno, taking control of your health and financial future is crucial. Nevada Silver offers a range of health insurance plans tailored to meet your needs and lifestyle. We encourage you to explore these options, get a quote, or contact an agent for personalized consultation. Investing in health insurance is not just a prudent decision for today; it's a step towards securing your future.

Health insurance is an important safety net that protects you and loved ones from the unexpected. Medical costs can rack up quickly even when you’re perfectly healthy, so it’s in your best interest to take advantage of open enrollment for health insurance. With the right plan, you’ll pay less for covered in-network health care and can enjoy benefits including free/reduced preventative care like vaccines, screenings, and check-ups.

If you’re looking for new or updated health insurance in Reno, you will need to apply during what is called Open Enrollment. Open Enrollment is the yearly period when people can enroll in a health insurance plan. Nevada’s enrollment period dates are as follows:

For coverage beginning January 1, 2023 individuals must enroll by December 31, 2022. Outside the Open Enrollment Period, you typically can only enroll in a health insurance plan if you qualify for a Special Enrollment Period.

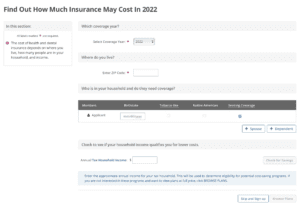

The first step of the enrollment process is to provide basic information about your income and household dynamics via the Nevada Health Link pre-screener tool. With this tool, you’ll be able to shop first and sign up later. Health insurance plans can differ significantly in cost and benefits. Consider scheduling an appointment with Nevada Silver, a Nevada Health Link preferred broker, to guide you through the shopping process.

When deciding on a plan, consider your overall needs. Are you healthy and don’t anticipate costly medical services throughout the year? Or do you or your family plan to have any procedures done due to medical issues?

It’s helpful to write down the medical services you or your family routinely use. Read the Summary of Benefits and Coverage within each plan to ensure these services are covered. Preventive services like annual check-ups or vaccine shots are usually free when performed by an in-network healthcare provider.

If you like to visit specific doctors, hospitals, or pharmacies, make sure they are in-network for plans you are considering. Most plans will not pay any health costs if you go out-of-network. And in the event that you do pay, those costs do not count towards your deductible or out-of-pocket maximum. Networks change from plan to plan. If a doctor is covered by one insurance plan, do NOT assume that they are covered by ALL plans under that insurance company. Though it can be daunting to narrow down the selection and sign up for a plan, Nevada Silver has the industry experience to help you navigate the process.

You’ll be hard-pressed to find other health insurance brokers in Reno NV with Nevada Silver’s level of hands-on guidance and expertise with trusted insurance providers. Our team’s goal is to make sure our clients have the necessary information to enroll in a plan that suits their specific health needs. If you have any questions about the upcoming Open Enrollment Period in Nevada, reach out to Nevada Silver for assistance.

It’s safe to say, we all focus on the holiday season as the end of the year approaches.

With many things to plan, such as upcoming feasts, gift exchanges, and holiday events, it’s possible to forget some of the important deadlines approaching that help ensure our livelihood.

One deadline quickly approaching is the end of the Open Enrollment period for health insurance purchases available to you and your family.

The deadline for enrollment is December 7th, 2021, so be sure to enroll in health insurance before it is too late!

Nevada Silver is here to guide you through what may feel like a complex and tedious process for many. We are the only Nevada Health Link preferred broker servicing Northern Nevada for over 16 years.

Let us walk you through some of the things you need to know before enrolling and remind you where you can enroll to receive benefits:

There are several types of insurance plans available to you and your family.

These categories are separated using Bronze, Silver, Gold, and Platinum to name their grade.

Each category highlights the variation in how much your plan will cost you depending on how you use it. There are also different plans and network types available to you. It is important to remember that this could lead to different experiences of the quality of service you receive.

Furthermore, there are tools to help you search, compare and assess providers and their facilities. We want to remind you of these details because they will help you find quality insurance that meets your budget.

There are many sites available to help you enroll.

Some of the ways you can enroll include going straight to each insurance site.

This may seem like the best approach for some but doing this may lead you to miss discounts or leave you paying higher premiums. The good news is,we can help you find out if you are qualified to receive any subsidies for plans and enroll in Medicaid. These subsidies are available to anyone who meets certain requirements such as job loss, marriage, new residency, and other qualifying circumstances.

Subsidies help you pay for health insurance or sometimes offer free access to care. Also, Nevada Health Link shows you a variety of plan options allowing you to compare multiple carriers. This service ensures you get the best plan for you and your family's health care needs at a price you can afford.

While using Nevada Health Link may be a walk in the park for some, Nevada Silver offers free guidance to anyone feeling confused about the process of obtaining the right health insurance.

Our staff offers over 35 years of joint experience and knowledge in the insurance industry. We help streamline the process by bringing you the best rates and highest quality customer service available to you.

We take the time to analyze your current health needs alongside helping you prepare for future events. Our agents calculate your premiums and make sure you don't miss any tax credit opportunities. We will not only guide you through the process of picking the right insurance, but also help you receive dental and vision at no cost to you.

Come to our team so we can hear and solve your concerns when it comes to finding the right plan. We are here to help you choose the best plan that fits your budget, needs, and life.

As the holiday season begins, many of us focus on the act of giving in order to bring joy to those we are most grateful for. Although we typically focus on gifting our loved ones with products and services, the best gift you can give just about anyone is practically free.

Talking to loved ones about life insurance is one gift you can give that adds to your family’s prosperity and longevity.

A survey from Spendmenot recently discovered 52% of Americans have life insurance. While that number may seem high, the number of Americans with life insurance has decreased in comparison to the previous years. This means approximately half the population will leave their loved ones with financial burdens if the primary wage earner unexpectedly passes.

Of course, you may ask yourself “how do I bring up such a heavy topic during the holiday season?”.

While it may seem awkward at first, caring for your family doesn't have to be. This holiday season, be sure to speak with your immediate and extended family members about various life insurance options and give a gift that will last a lifetime.

Here you will find three simple questions to help guide you when talking to loved ones about insurance options.

This is the best place to start because it allows a simple introduction to a complex topic. This question is great because it can apply to any of your family members and not necessarily focuses on health insurance alone.

Many of us think insurance only begins with yearly coverage, so this question allows you to draw attention to the importance of life insurance no matter how your family answers. Furthermore, life insurance goes beyond elderly insurance. Meaning this question is important for your younger relatives since it can become a form of financial planning. This can help guide your family in a positive direction this holiday season.

This question may help address your family members' misunderstandings of life insurance. Some of us may think life insurance only offers our loved ones benefits if we pass away, but it can also act as a safety-net in our daily lives.

Life insurance can pay bills and cover debts alongside protecting those who rely on your income.

According to NEA members, these protections help you when mapping out future milestones such as marriage, parenting, home buying, and retirement.

Ultimately, no matter what your age is, investing in life insurance allows you to support and reduce stress for yourself and your loved ones even after you pass.

This question should be asked to help understand what kinds of resources there are to your family members.

They may trust a close friend, family member, financial advisor, certified insurance broker, or themselves when it comes to their finances.

A recent study suggests many Americans are changing who they turn to for financial advice.

Only 26% of Americans trust financial advisors which is a 4% decrease from 2020. The most common person an individual turns to is a spouse or a family member, making your role in addressing life insurance highly valuable. This answer will ensure that your family finds the right resources when it comes to signing up for the right type of insurance.

Although you provide options for your family members when talking about life insurance, it is important to acknowledge insurance as a financial protection policy.

Going to a certified broker like Nevada Silver allows you to find the right protection whether you are single, married, or even own a business. As the only Nevada Health Link insurance broker in Northern Nevada, we focus on alleviating the guesswork when finding the best coverage for you and your family’s needs.

When all is said and done, your role in talking to your loved ones about their insurance options is more valuable than you know. Starting this conversation over the holidays is a step in the right direction for many individuals looking for insurance options going into 2022. The goal for you is to make sure your family and those you love are insured.

Feel free to use these questions on all of the people you care about this holiday season. Many will be grateful for your support in their future success. If you don't feel comfortable guiding your family through the process of becoming insured, remember a certified life insurance broker is available to guide them. Brokers like Nevada Silver help others gain access to Northern Nevada insurance options by working with a variety of insurance companies. So give the timeless gift of having a conversation with your loved ones regarding the best life insurance options for their needs.

To determine what kind of life Insurance you need, call the Nevada Silver Life Health Insurance agency and ask for Gina or John @ 775-829-1221, who can help determine what is the best for your Needs for life insurance and what will fit your budget the best!

Ensuring you or your loved ones are covered for long term care should be top of mind for anyone nearing their senior years. This November is National Long Term Care Month, a movement that was started to emphasize the importance of long-term care and how important it is for people to get involved in preparing for their future. As we age we begin to realize the need for having adequate health coverage, but often lack the information necessary to obtain it. Fortunately, working with Nevada Silver Life Insurance, the state’s only Nevada health link preferred broker, makes obtaining long-term care insurance a breeze.

Learn more about Long Term Care Month and your insurance coverage options with Nevada Silver Life and Health Insurance by reading below.

Long-term care is often necessary for seniors who are unable to handle daily tasks such as eating, bathing, or dressing on their own. These needs commonly go unmet due to a lack of proper long-term care coverage and accessibility, resulting in family members taking on the role of caregiver for their loved ones. However, this isn’t always possible as many adults have other responsibilities such as work that impede this possibility.

On average, 78% of adults receiving long-term care rely solely on their family or friends for assistance. The caregiver typically spends 21 hours a week caring for their loved one and roughly 90% of these people had to permanently alter their work schedules to provide such care.

Long-term care insurance ensures that those who require long-term care get the assistance they need while allowing their family members to continue their daily routines.

Medicare is ideal for individuals who are turning 65 or are over the age of 65 and are looking for health insurance that will help them maintain their current health and protect them from circumstances that are unplanned. Medicare open enrollment for seniors consists of two main parts; Part A and Part B. Seniors who take advantage of Medicare health insurance must enroll in both Parts A and B to be considered covered.

Medicare Supplements, also called Medigap Plans, are designed to help pay for certain health care costs that are not covered by Medicare Parts A or B. Likewise, Medicare Advantage Plans offer people with Medicare additional benefits beyond the standard Medicare coverage through an approved HMO.

Medicare Open Enrollment began on October 15th and will remain open until December 7th. If you need help enrolling in Medicare benefits, the expert insurance agents at Nevada Silver are there for you. There’s still time to get your Medicare benefits this year. If you are in need of assistance enrolling or reviewing your current plan contact us today!

Nevada Health Link is a resource available to all Nevadans that helps them find affordable health insurance plans that meet their unique needs and budget. Nevada Silver Life and Health Insurance Agency has many options for your family’s individual health insurance.

You can purchase plans privately or through the Nevada State Exchange Marketplace, Nevada Health Link, which makes the process of signing up for health coverage simple. There are other benefits to purchasing health insurance through Nevada Health Link such as receiving premium tax credits and subsidies to cover the cost of your health insurance.

Nevada Health Link’s Open Enrollment will begin on November 1st and runs through January 15th. To ensure you receive health coverage by February 1, 2022, connect with Nevada Silver. As the only Nevada Healthlink Preferred Broker in Northern Nevada, we’re able to provide the most streamlined assistance possible.

Are you interested in working with certified health insurance brokers? Our agents at NV Silver Life and Health Insurance are here to help you find the best plan for you. Contact us today!

The first year I started selling life Insurance, I was an agent for New York Life in 1989 and 1990 and my first assignment was to develop a list of 100 people I knew, contact them for an appointment to tell them what I was doing now and determine if I could assist them in repositioning any of their assets to help them better maximize their returns…

This strategy also helped them to visually see & determine where there were gaps in their coverages and allowed me to present approiate life insurance products that could fill those gaps… One of my first Life Insurance Sales was to a young man who I been associated with in my previous career for a $100,000 Term Policy to provide a benefit for his mother and two children in the event something happened to him… He had just recently gone thru a “bitter” divorce with his wife and had gained custody of his two children who were being carried for by himself and his mother, who also worked full time at one of our local hospital’s in the Housekeeping department…

Six months after I had delivered his policy, I received a call from his brother, inquiring if his policy was still in force….!!!! The very first thing I asked politely was why he was inquiring as that type of information is confidential and not given out to anyone except the insured or owner of the policy… The brother then told me that the insured, His brother had a motorcycle accident and had been killed two months previously and he was trying to help settle his brother’s affairs…

At that point, I immediately checked to make sure the premium had been paid a the policy was still in force and informed the Carrier, New York Life, of the insured death and instructed them where to send the death Claim paperwork that has to be filed along with a “Certified Death Certificate” in order for the Claim to be processed… Because he had been riding a motorcycle The Carrier in turn investigated the claim and fornatuately this Hazardous activity had been indicated on his application the claim was honored two months later and his primary beneficiary, his mother Received a Check for The $100,00 plus interest for the two months delay in delivery of the claim…

Needless to say this was more money than his mother had ever seen in her entire life, as she was 66 at the time this event occurred and she was overwhelmed with what to do with the money…. Her daughter at time that was assisting her in settling her deceased brother’s affairs and I met with both of them when I delivered her check…. They both looked at me in bewilderment and simply inquired what I thought they should do with the money…

I suggested four options for their consideration: