Health insurance is a crucial aspect of life, providing the financial support needed to cover medical expenses when illness or accidents strike. If you're a resident of Reno, NV, securing the right health insurance coverage is essential for your well-being and peace of mind. Fortunately, Nevada Silver Life & Health Insurance Agency is here to help you navigate the complex world of health insurance, and they are a Preferred Broker with Nevada Health Link, the state's official health insurance marketplace.

In this blog post, we'll delve into the importance of having a trusted partner like Nevada Silver Life & Health Insurance Agency by your side when seeking health insurance in Reno, NV. We'll also explore the benefits of working with a Preferred Broker through Nevada Health Link.

Reno, often called "The Biggest Little City in the World," is known for its vibrant culture, stunning natural landscapes, and an abundance of outdoor recreational activities. However, like any other place, health-related emergencies can happen, and having adequate health insurance can make a significant difference in your ability to access timely and quality medical care without facing crippling financial burdens.

Navigating the complex world of health insurance can be overwhelming. Nevada Silver Life & Health Insurance Agency boasts a team of experts who understand the unique healthcare landscape in Reno, NV. They can guide you through the various health insurance options available, ensuring you choose a plan that aligns with your needs and budget.

Nevada Silver Life & Health Insurance Agency's Preferred Broker status with Nevada Health Link is a testament to their commitment to serving the local community. As a Preferred Broker, they have direct access to the latest information on available health insurance plans, subsidies, and enrollment periods, allowing them to provide you with up-to-date, accurate advice.

Not all health insurance plans are created equal, and your unique circumstances require a tailored approach. Whether you're an individual seeking coverage or a business owner looking for group health insurance, Nevada Silver Life & Health Insurance Agency can design a personalized solution that meets your specific needs.

Health insurance can be expensive, but it's an investment in your well-being. Nevada Silver Life & Health Insurance Agency can help you identify cost-effective plans that provide comprehensive coverage. Additionally, they handle the paperwork and enrollment process, saving you valuable time and ensuring your application is processed smoothly.

Your relationship with Nevada Silver Life & Health Insurance Agency doesn't end once you've enrolled in a plan. They provide ongoing support, helping you understand your benefits, navigate claims, and make necessary adjustments to your coverage as your circumstances change.

In Reno, NV, having the right health insurance coverage is essential for your peace of mind and financial security. Nevada Silver Life & Health Insurance Agency, a Preferred Broker with Nevada Health Link, is your trusted partner in this journey. With their expertise, personalized solutions, and ongoing support, they make sure you get the health insurance coverage that suits your needs and budget. Don't leave your health to chance; let Nevada Silver Life & Health Insurance Agency guide you through the maze of health insurance in Reno, NV, and help you secure the protection you deserve. Visit their website at https://nvsilver.com to learn more and get started today. Your health and well-being are worth it.

Medicare is a crucial part of the American healthcare system, providing essential coverage to millions of seniors across the nation. Understanding Medicare is vital for seniors as it ensures they receive the medical care they need while managing costs effectively. In this blog post, we'll break down the basics of Medicare, including eligibility, enrollment options, and key information that every senior should know.

What is Medicare?

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older. It also provides coverage for certain younger individuals with disabilities. The program helps cover various healthcare services, making it an essential safety net for seniors during their retirement years.

Medicare Parts: A Brief Overview

Medicare consists of several parts, each serving a specific purpose:

Eligibility for Medicare

To be eligible for Medicare, you must meet one of the following criteria:

Enrollment Options for Seniors

Understanding when and how to enroll in Medicare is essential to ensure you have the coverage you need when you need it. Here are some key enrollment periods to be aware of:

Medicare Myths to Debunk

Misconceptions about Medicare can lead to confusion. Let's debunk a couple of common myths:

The Importance of Medigap

Medigap, also known as Medicare Supplement Insurance, is a type of private insurance designed to cover the out-of-pocket costs that Medicare doesn't. It can help you manage deductibles, copayments, and coinsurance, ensuring that your healthcare costs are more predictable and manageable.

Conclusion

Medicare is an invaluable resource for seniors, offering access to necessary healthcare services during their retirement years. Understanding the basics of Medicare, including eligibility, enrollment options, and the role of supplemental insurance like Medigap, is essential for making informed decisions about your healthcare coverage.

If you have questions or need personalized guidance on Medicare, don't hesitate to reach out to a licensed insurance professional. They can help you navigate the complexities of Medicare and ensure you choose the right plan for your unique needs and preferences. By understanding the fundamentals of Medicare, you can enjoy your retirement years with confidence in your healthcare coverage.

Open enrollment is a crucial period in the world of health insurance, offering individuals the opportunity to reassess and adjust their healthcare coverage. It's an annual window during which you can make important decisions that impact your health, finances, and overall well-being. In this blog post, we'll explain the significance of open enrollment for health insurance and provide tips on how to maximize the benefits of this period.

What Is Open Enrollment?

Open enrollment is a specific timeframe each year when you can enroll in or make changes to your health insurance plan. This period typically occurs toward the end of the calendar year, and the exact dates may vary depending on your specific plan or the healthcare marketplace you use. In Nevada, Open Enrollment is November 1-January 15, 2024.

During open enrollment, you can do the following:

Why Is Open Enrollment Important?

Open enrollment plays a pivotal role in ensuring that you have the right health insurance coverage for your needs. Here's why it's so important:

Tips for Making the Most of Open Enrollment

Now that you understand the significance of open enrollment, here are some tips to help you navigate this period effectively:

In conclusion, open enrollment is a crucial period for reviewing, adjusting, and optimizing your health insurance coverage. By marking the dates, reviewing your current plan, assessing your health needs, shopping around, and seeking professional assistance, you can make the most of this opportunity to secure the right coverage for you and your family. Open enrollment is your chance to take control of your healthcare and ensure you have the protection you need for the year ahead.

When it comes to navigating the complex world of insurance, partnering with an insurance broker can provide significant advantages. At NV Silver Agency, we understand that finding the right insurance coverage can be overwhelming, especially if you're uncertain about your specific needs. Here's why choosing our experienced insurance agency as your trusted insurance brokers is a smart choice:

As your insurance broker, we have extensive connections and deep knowledge of the insurance market. This enables us to access policies from multiple insurance companies and present you with a variety of options to choose from. By leveraging our expertise, we can often find better value for your insurance dollar than you might discover on your own. We take the time to compare coverage, premiums, and benefits across various plans, ensuring that you receive the most suitable and cost-effective solution.

When you work with us, rest assured that we have your best interests at heart. As your insurance broker, we represent you, the consumer. We act as your advocate, searching for policies that align with your specific needs and preferences. Navigating insurance networks can be challenging without expert knowledge. By leveraging our expertise, we guide you in finding the plan that not only meets your medical needs but also fits within your budget.

Each individual's insurance requirements are unique. As your insurance broker, we take the time to comprehensively evaluate your needs. We engage in a detailed conversation to understand your specific circumstances, medical history, and financial situation. By gaining a holistic understanding of your requirements, we can recommend the most suitable plans that strike the right balance between price, coverage, and service. Our goal is to tailor a solution that caters to your specific needs, ensuring you receive the coverage that meets your expectations.

We provide exceptional service and support throughout the year. As your dedicated insurance brokers, we are there for you when you need us. Whether you encounter challenges with a claim, have questions about your policy, or need assistance with payments, we are your reliable point of contact. You can count on our agency to handle any issues that may arise, providing you with peace of mind and the assurance that your insurance matters are in capable hands.

By utilizing the services of an insurance broker like NV Silver Agency, you gain access to a wealth of knowledge, extensive options, and ongoing support. We simplify the insurance process, empowering you to make informed decisions and secure the coverage you need. Trust us to be your dedicated partner, guiding you every step of the way, and ensuring that you receive the insurance solutions that best align with your requirements. Contact us today to experience the advantages of having professional insurance brokers.

At Nevada Silver, we understand that health insurance is just one aspect of your overall well-being. That's why we proudly extend our services to include a wide array of additional coverages in the insurance industry that seamlessly complement your health insurance. Take a moment to explore our insurance agency options in Nevada available to our valued clients:

Discover the myriad benefits of choosing Nevada Silver Life and Health Agency as your trusted insurance provider. While our primary focus lies in offering exceptional health insurance coverage, we go above and beyond to provide a diverse range of complementary coverages to meet all of your insurance needs. We believe in offering a comprehensive package that ensures your peace of mind and protects you and your loved ones from unexpected financial burdens.

To learn more about the full range of coverages we offer and to receive a personalized quote, we encourage you to contact our dedicated team of agents: Gina, David, John, and Mary Lou. With their expertise and knowledge of the insurance landscape, they will guide you in selecting the plan that best aligns with your unique needs.

Connect with us today at NVSilver Life and Health LLC by calling 775-829-1221. Discover the peace of mind that comes from having comprehensive coverage that truly addresses all aspects of your life. Nevada Silver Life and Health Agency is committed to providing exceptional insurance solutions and ensuring your well-being every step of the way. Trust us to be your comprehensive insurance solution in Nevada.

Navigating Reno health insurance can be overwhelming, with a vast array of complex terminologies and countless options to choose from. However, it is essential to take the time to carefully consider your options when selecting a plan to ensure that it meets your healthcare needs and budget. One crucial factor to consider is the network, which refers to the group of healthcare providers and facilities covered by the plan.

Understanding what a health insurance network is and why it matters is key to selecting the right plan. Different types of networks, such as HMO, PPO, and EPO, each have their own advantages and disadvantages, including provider choice, referrals, and out-of-network coverage. For instance, HMOs typically require you to select a primary care physician who serves as your primary point of contact for all of your healthcare needs and requires referrals to see specialists. PPOs, on the other hand, offer greater flexibility in choosing your healthcare providers but often come with higher premiums.

A comprehensive network includes a wide range of healthcare providers and facilities in your area, ensuring that you have access to the care you need. When evaluating whether a Reno health insurance plan has a comprehensive network, one important factor to consider is the plan's provider directory, which lists the healthcare providers and facilities covered by the plan. It is essential to verify that the healthcare providers you prefer are included in the network, particularly if you have pre-existing conditions that require ongoing care.

A comprehensive network includes a wide range of healthcare providers and facilities in your area, ensuring that you have access to the care you need. When evaluating whether a Reno health insurance plan has a comprehensive network, one important factor to consider is the plan's provider directory, which lists the healthcare providers and facilities covered by the plan. It is essential to verify that the healthcare providers you prefer are included in the network, particularly if you have pre-existing conditions that require ongoing care.

In addition, it is important to consider whether the plan requires referrals to see specialists and whether it provides coverage for out-of-network care. Referrals can be a significant obstacle to receiving timely and appropriate care, particularly if you have a chronic health condition. Out-of-network coverage can be a crucial factor if you need to see a specialist who is not included in your plan's network, as out-of-pocket expenses can quickly add up.

Of course, cost is also a significant consideration when selecting a Reno health insurance plan. Premiums, deductibles, and co-pays can vary widely between plans, and it's important to understand how these costs may impact your budget. When comparing plan costs, it's also important to consider how network coverage may affect your expenses. For example, a plan with a comprehensive network may have lower out-of-pocket expenses and may reduce the need for referrals.

While network coverage is a crucial factor to consider, there are also other factors that can impact the value of a Reno health insurance plan. You'll want to consider whether the plan provides prescription drug coverage, as well as any additional benefits such as wellness programs or telehealth services. These factors can be weighed against network coverage to determine which plan offers the best overall value for your healthcare needs and budget.

Choosing a health insurance plan can be a daunting task. But taking the time to research your options and evaluate network coverage can help ensure that you select a plan that meets your needs and budget. Remember to consider factors such as provider directories, referrals, out-of-network coverage, and plan costs when comparing options. By selecting a plan with a comprehensive network, you can ensure that you have access to the healthcare providers and facilities you need, when you need them.

Connect with Nevada Silver to Discuss Your Reno Health Insurance Options.

Dental and vision care frequently get neglected when it comes to taking care of our health. Having insurance coverage for these two healthcare specialties is essential because they are equally important to your overall physical health, which in return can help you feel more confident & happy with your life.

As a Nevada-based health insurance broker, we have direct experience with the value of having complete coverage for all facets of your health. Managed care and indemnity plans are the two primary categories of dental insurance. Indemnity plans typically have higher premiums and deductibles, but allow you to choose any dentist you want. Managed care plans, on the other hand, typically have lower costs and a network of approved providers that you must choose from. Your unique demands and preferences will determine which plan is ideal for you.

Similarly, there are two types of vision insurance plans: discount plans and managed care plans. Discount plans offer reduced rates on vision care services and products, but do not cover the cost of exams or procedures. Managed care plans, on the other hand, have a network of providers and offer comprehensive coverage for exams, procedures, and products. Consider your frequency of vision care needs as well as whether you would prefer the flexibility of a discount plan or the all-inclusive coverage of a managed care plan when choosing the ideal plan for you.

At NV Silver, we understand that navigating the world of insurance can be overwhelming. To identify the finest dental & vision insurance policies for each of our clients' particular needs, we work our hardest to help you find the best plan that suits your needs. Dental and vision care are equally as crucial to maintaining good mental health as well as physical wellness. You should make sure that you have access to the treatment you deserve when you require it by selecting the best insurance plan for your circumstances. NV Silver is dedicated to assisting our clients in locating the best dental and vision insurance programs for their particular needs.

To provide our clients with the greatest available coverage alternatives, we collaborate with a number of insurance companies. We provide a variety of dental and vision insurance plans to fit all budgets and lifestyles since we recognize that everyone's needs vary. We can assist you in finding the ideal plan, whether you require simple coverage for regular exams or more extensive coverage for procedures and items.

It's important to remember that based on the specific services and operations you require, dental and vision insurance policies may offer varying levels of coverage. For example, some plans may cover basic cleanings and exams, but not more complex procedures like root canals or orthodontics. Make sure to read the small print and comprehend what is and is not included when selecting a plan.

At NV Silver, we are committed to helping our clients make informed decisions about their healthcare coverage. We can assist you in navigating the complicated insurance market to locate the best plan for your requirements, whether you require dental or vision insurance. Your interests and tastes will be fully understood by our seasoned brokers as they work closely with you one-on-one to help you choose and enroll in a plan.

Finding a plan that matches your needs & offers you the coverage you require for your dental & vision care can be made easier by taking the time to study and evaluate various plans and providers. So don't wait any longer, start exploring your dental and vision insurance options today and take the first step towards better oral and visual health with NV Silver.

The COVID-19 pandemic has significantly impacted every aspect of our lives, including our healthcare system. As a result of the pandemic, nearly all Medicaid and Children's Health Insurance Program (CHIP) members were able to stay enrolled regardless of changes in eligibility or status. This policy helped ensure that people had access to the healthcare they needed during a time of crisis. However, the continuous enrollment policy is now coming to an end, and it will affect nearly 938,000 people in Nevada alone.

The expiration of the continuous coverage policy will represent the single largest health coverage transition event since the first open enrollment period of the Affordable Care Act. It is believed that many people will not even be aware that they have lost their benefits, which could have serious consequences for their health. So, what does this mean for Medicaid beneficiaries in Nevada?

Some Reno Medicaid members may be automatically renewed by their Medicaid agency based on information the state uses to confirm eligibility, such as tax returns, bank accounts, unemployment, or SNAP eligibility. However, others may need to take action and provide documentation to verify their Medicaid eligibility. Beneficiaries will be notified by their state Medicaid agency via postal mail or email when they are having their coverage redetermined.

It is important to note that if you receive a notification that your coverage is being redetermined, you should not ignore it. Even if you know that you do not qualify, it is necessary to complete all paperwork received from Medicaid. This will allow you to seek alternative coverage options and avoid any potential gaps in your health insurance coverage.

If you receive a notice that your eligibility has been terminated based on information received or accessed by Medicaid, you may be left without health insurance coverage. However, you should not panic. Instead, you should call a local health professional agent (like Nevada Silver Life & Health) and seek an appointment to discuss your options. You may be eligible for alternative coverage options, such as a new affordable health plan on the Nevada Health Link Exchange, which can help you avoid any gaps in your health insurance coverage.

The end of Medicaid continuous enrollment is a significant event that will impact nearly one million people in Nevada alone. It is essential that Medicaid beneficiaries in Nevada stay informed and take action to ensure that they have access to the healthcare they need. Whether you are automatically renewed or need to provide additional documentation to verify your eligibility, it is essential that you stay on top of the process and seek help if needed. By doing so, you can help ensure that you and your family have access to the healthcare you need during this challenging time.

If you're a Reno resident, securing quality health insurance for your family is crucial. At NV Silver, we offer health insurance plans that are designed to meet the unique needs of Nevada residents. We'll explore the advantages of having comprehensive health insurance coverage for your family and how working with a health insurance broker can simplify the process.

Comprehensive health insurance is essential for safeguarding the health and well-being of your family. This type of coverage offers protection against a wide range of medical expenses, including hospitalization, surgery, doctor visits, and prescription drugs. It's particularly important if anyone in your family has a chronic health condition or requires regular medical care. With comprehensive coverage, you'll have peace of mind knowing that you won't have to pay for unexpected medical bills out of pocket.

When looking for Reno health insurance, consider partnering with a health insurance broker. These licensed professionals possess in-depth knowledge about the insurance industry and can provide expert advice on the most suitable plan for your family's needs.

Time-Saving: Shopping for insurance can be time-consuming, but a broker can do the research for you. They'll compare plans and prices from different insurance companies, making it easier for you to choose the right coverage.

Access to More Plans: Health insurance brokers work with multiple insurance companies, giving you access to a wide range of coverage options.

Personalized Service: Brokers work with you one-on-one to understand your family's needs and recommend the best plan for you.

Expertise: Health insurance brokers are experts in their field and can help you navigate the insurance marketplace with ease.

At NV Silver, we understand that comprehensive health insurance coverage is essential for protecting your family's health and well-being. Our team of experienced professionals can help you choose the best coverage option for your family's needs. As a health insurance broker, we work with multiple insurance companies, providing you with access to a broad range of health insurance plans.

Don't wait until it's too late to get Reno health insurance coverage for your family. Contact NV Silver today to learn more about our comprehensive health insurance plans and how we can help you find the right coverage. Whether you need coverage for your entire family or just for yourself, we have a plan that's tailored to your specific needs. Protect your family's health and well-being with comprehensive health insurance from NV Silver.

Health insurance is an important safety net that protects you and loved ones from the unexpected. Medical costs can rack up quickly even when you’re perfectly healthy, so it’s in your best interest to take advantage of open enrollment for health insurance. With the right plan, you’ll pay less for covered in-network health care and can enjoy benefits including free/reduced preventative care like vaccines, screenings, and check-ups.

If you’re looking for new or updated health insurance in Reno, you will need to apply during what is called Open Enrollment. Open Enrollment is the yearly period when people can enroll in a health insurance plan. Nevada’s enrollment period dates are as follows:

For coverage beginning January 1, 2023 individuals must enroll by December 31, 2022. Outside the Open Enrollment Period, you typically can only enroll in a health insurance plan if you qualify for a Special Enrollment Period.

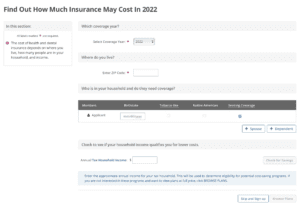

The first step of the enrollment process is to provide basic information about your income and household dynamics via the Nevada Health Link pre-screener tool. With this tool, you’ll be able to shop first and sign up later. Health insurance plans can differ significantly in cost and benefits. Consider scheduling an appointment with Nevada Silver, a Nevada Health Link preferred broker, to guide you through the shopping process.

When deciding on a plan, consider your overall needs. Are you healthy and don’t anticipate costly medical services throughout the year? Or do you or your family plan to have any procedures done due to medical issues?

It’s helpful to write down the medical services you or your family routinely use. Read the Summary of Benefits and Coverage within each plan to ensure these services are covered. Preventive services like annual check-ups or vaccine shots are usually free when performed by an in-network healthcare provider.

If you like to visit specific doctors, hospitals, or pharmacies, make sure they are in-network for plans you are considering. Most plans will not pay any health costs if you go out-of-network. And in the event that you do pay, those costs do not count towards your deductible or out-of-pocket maximum. Networks change from plan to plan. If a doctor is covered by one insurance plan, do NOT assume that they are covered by ALL plans under that insurance company. Though it can be daunting to narrow down the selection and sign up for a plan, Nevada Silver has the industry experience to help you navigate the process.

You’ll be hard-pressed to find other health insurance brokers in Reno NV with Nevada Silver’s level of hands-on guidance and expertise with trusted insurance providers. Our team’s goal is to make sure our clients have the necessary information to enroll in a plan that suits their specific health needs. If you have any questions about the upcoming Open Enrollment Period in Nevada, reach out to Nevada Silver for assistance.