Health insurance is an important safety net that protects you and loved ones from the unexpected. Medical costs can rack up quickly even when you’re perfectly healthy, so it’s in your best interest to take advantage of open enrollment for health insurance. With the right plan, you’ll pay less for covered in-network health care and can enjoy benefits including free/reduced preventative care like vaccines, screenings, and check-ups.

If you’re looking for new or updated health insurance in Reno, you will need to apply during what is called Open Enrollment. Open Enrollment is the yearly period when people can enroll in a health insurance plan. Nevada’s enrollment period dates are as follows:

For coverage beginning January 1, 2023 individuals must enroll by December 31, 2022. Outside the Open Enrollment Period, you typically can only enroll in a health insurance plan if you qualify for a Special Enrollment Period.

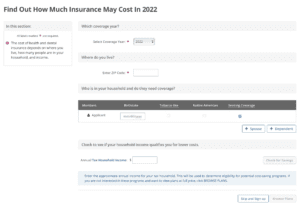

The first step of the enrollment process is to provide basic information about your income and household dynamics via the Nevada Health Link pre-screener tool. With this tool, you’ll be able to shop first and sign up later. Health insurance plans can differ significantly in cost and benefits. Consider scheduling an appointment with Nevada Silver, a Nevada Health Link preferred broker, to guide you through the shopping process.

When deciding on a plan, consider your overall needs. Are you healthy and don’t anticipate costly medical services throughout the year? Or do you or your family plan to have any procedures done due to medical issues?

It’s helpful to write down the medical services you or your family routinely use. Read the Summary of Benefits and Coverage within each plan to ensure these services are covered. Preventive services like annual check-ups or vaccine shots are usually free when performed by an in-network healthcare provider.

If you like to visit specific doctors, hospitals, or pharmacies, make sure they are in-network for plans you are considering. Most plans will not pay any health costs if you go out-of-network. And in the event that you do pay, those costs do not count towards your deductible or out-of-pocket maximum. Networks change from plan to plan. If a doctor is covered by one insurance plan, do NOT assume that they are covered by ALL plans under that insurance company. Though it can be daunting to narrow down the selection and sign up for a plan, Nevada Silver has the industry experience to help you navigate the process.

You’ll be hard-pressed to find other health insurance brokers in Reno NV with Nevada Silver’s level of hands-on guidance and expertise with trusted insurance providers. Our team’s goal is to make sure our clients have the necessary information to enroll in a plan that suits their specific health needs. If you have any questions about the upcoming Open Enrollment Period in Nevada, reach out to Nevada Silver for assistance.

May is Disability Insurance Awareness Month and to promote the importance of disability insurance, we’re arming everyone we can with valuable information to prepare them for setting up their own policy. While you may be thinking that your home or retirement plan is your biggest asset, you’d be mistaken. Actually, your lifetime earning potential is your greatest asset as it ensures continuous income.

Disability insurance protects your income, the asset on which you rely to live. It also provides much-needed reassurance and peace of mind that you won’t lose that income in the event that you become ill or disabled. The Nevada Silver Life & Health insurance Agents at NV Silver are here to help you understand your insurance options to choose the right plan. Learn more with us below!

To determine a disability insurance policy that’s right for you, we recommend following the 3-Step Approach:

With this 3-Step approach and the help of our agency in Reno, you won’t have to worry about your coverage or its benefits!

Just 14% of Americans claimed to have disability insurance in 2021, yet, 45% of Americans acknowledge that their families would struggle financially if a primary wage earner was unable to earn income due to an illness or disability. So, what are the reasons they have for not having disability coverage? The three most common reasons are that disability insurance is too expensive, families prioritize other financial obligations, and many people just don’t feel like they need it.

Reno health insurance professionals are able to find disability insurance that is affordable and ensures the most reliable coverage in the event that you become ill or disabled. No one expects a circumstance such as these to cost them their entire income, but disability insurance provides the best backup plan to make certain that your family has consistent funds coming in.

Equifax, Experion, and TransUnion, the 3 major national credit reporting agencies, announced significant changes regarding medical debt reporting. Effective July 1, 2022, nearly 70% of medical collection debt will be erased from consumer credit reports. This means that substantially high medical bills may no longer present themselves on credit reports among the top credit reporting agencies posing a huge benefit to consumers.

Specifically, the changes include the following conditions:

If you’re interested in learning more about disability insurance or general health insurance in Nevada, you’ve come to the right place. Our health insurance experts will help you find the plan that best fits your needs. Connect with us today!

The end of the tax season is quickly approaching, have you filed yet? If not, there’s no need to worry, you still have some time. The hardest part of filing your tax returns is often locating and tracking down all of the documentation and paperwork you need to reference. In regards to the health insurance portion of your taxes, there are three key forms you’ll need to have handy. But that may not be all. To properly file your 2021 taxes, learn more about the necessary Nevada health insurance documents you’ll need with the Reno health insurance experts at NV Silver.

It’s obvious that you’ll need to have your W-2 on hand to file your taxes, but do you know what health insurance documents you need? If you had health insurance coverage in 2021 then you were likely sent a 1095 form that outlines the details of your insurance premiums. These, along with documents such as your insurance cards, statements from your insurer, and records of advance payments from premium tax credits (APTC) may all be helpful in accurately filing your taxes.

The necessary Nevada health tax documents required to file your tax return include the following:

Form 1095-A is provided to individuals who enroll in a qualified health plan through the Health Insurance Marketplace. This form comes from the marketplace, either through the federal marketplace or a state-run health care exchange, not the IRS. This form essentially acknowledges that you and possibly others in your household were enrolled in a health coverage plan for the year. Some specific information provided in this form include:

Form 1095-B is sent to individuals covered under a medical health coverage plan by their health insurance provider, such as an insurance company. The document includes information about who was covered under the policy and when they were covered. This form is sent to individuals who have bought health insurance coverage from a provider outside of the marketplace or employer-provided network. A few examples of such an insurance policy are government programs like Medicare and the Children’s Health Insurance Program (CHIP).

Form 1095-C is sent by companies to their employees. This form proves that the employee, and possibly members of their family, were enrolled in an employer-provided health insurance plan. Typically, it is up to the employee whether or not they participate in their work’s health coverage offer, and while most employees choose to go this route, some seek coverage elsewhere. It’s up to the employer to report to the IRS which employees have chosen to participate in their health plans.

Like Form 1095-A, Form 1095-C includes information about who was covered by the policy and when.

If you’re still a bit confused about your Nevada health tax documents, that’s okay. Our Reno health insurance agents are here to answer all of your questions in regards to your health tax documents. Just give our office a call at 775.829.1221, or connect with us online! Whether you need assistance with a health insurance plan for seniors, want to discuss life insurance options, or have a question about your taxes, we’re here to help.

Are you new to Nevada? While there are many benefits of moving from California to Nevada, NV Silver wants to remind senior residents of a new health insurance law they will find useful. This advantage is known as the Nevada birthday rule.

You can think of this law as a special birthday gift from the state of Nevada. While Medicare providers are obligated to inform you of open enrollment for the birthday rule, reaching out to an insurance broker can help you make a quick and informed decision in the future.

The birthday rule is an insurance law that allows seniors with Medicare (also known as Medigap) to lower their insurance rates and save money on prescriptions each year. Most importantly, you are not required to answer health questions that could harm your eligibility or higher your rate. Just keep in mind that your replacement plan should offer equal or lesser benefits for you to qualify.

All Medicare Supplement plans experience at least one rate increase every year. This Nevada health insurance law allows you to shop for plans in your budget around your birthday. Now you can switch your coverage to receive the lowest rate even if your health status has changed. Just follow the requirements for switching plans, and you are guaranteed to be accepted.

*Keep in mind: You have to already have Medicare Supplement, or Medigap to use the birthday rule.

Most people are under the impression that they can only change their Medicare Supplement benefits during the enrollment period, but this isn’t true. Instead, you can switch your plan anytime, but be ready to answer a series of health questions to qualify. Avoiding these questions is what makes the birthday rule so special. Now you can switch plans and never worry about being disqualified from receiving coverage for new health concerns.

One thing to keep in mind is that you can only use the birthday rule around your birthday. You are qualified to switch providers or plans beginning on the first day of your birthday month. The window for enrolling and avoiding new questions lasts 60 days, so you should act fast. Talking with a licensed insurance broker helps you streamline the process and guarantee you receive the best coverage and price possible.

The birthday rule is the best way for you to receive affordable health coverage all year long. Contact us now or visit our site to see how we can help you understand and use the birthday rule to your advantage. NV Silver has an insurance broker in Reno ready to work closely with you and guide you through the process.

Health insurance policies can be confusing and finding providers that work with your insurance company in Reno can be a challenge. Seeing an in-network physician in an in-network medical facility is the only way to limit your out-of-pocket medical expenses to the minimal amount possible. Unfortunately, it’s common for patients to receive surprise medical bills from a provider who they thought was in-network but turned out not to be.

So, how do you ensure you find an in-network medical provider that is covered by your insurance policy? NV Silver Life & Health Insurance Agency is here to clear things up.

To understand your health insurance coverage, you must understand how insurance networks function. Networks are created by insurance companies who then ask healthcare providers to charge patients a specified rate for particular services. Providers that agree to the suggested rates are considered “in-network providers”. If a provider does not agree to the rates and does not join the network, then they would be considered an “out-of-network provider” with your insurance company.

In-network providers’ services are covered to a certain degree (depending on your health insurance policy) while out-of-network services may not be covered at all, leaving the patient to pay their medical bill in full.

When it comes to health insurance, things aren’t always so cut and dry. There are several factors involved that can affect the coverage you receive. For instance, an in-network hospital or medical facility may contract out-of-network providers or physicians to work in their offices. So while the facility which you visited may be in-network and therefore covered, the doctor is not covered by your insurance because they are out-of-network.

There are multiple methods for verifying which healthcare providers are in-network with your insurance policy. To ensure your services are covered by your health insurance, be sure to verify your coverage with the facility and the practicing physician before your scheduled appointment. And remember, just because the medical office or hospital falls under your insurance coverage plan, doesn’t mean that the doctor is.

Connect with NV Silver Today

Connect with NV Silver Today Finding a medical provider that is covered by your insurance policy can help alleviate a lot of stress surrounding your medical needs. Medical costs are a top reason why Americans aren’t actively seeking medical care. This is especially true for seniors in need of health insurance. Connect with the insurance agents at Nevada Silver today!